Journey of a Sale: Strategic Research Transforming Sales Enablement

Project Timeline: 2025

Sr. UX Designer | Research Lead & Strategic Partner

Strategic Research Study

My Role

Led comprehensive strategic research initiative to map the complete Premium sales journey. Designed multi-phase research approach, facilitated discovery across diverse stakeholder groups, synthesized complex findings into actionable framework, and delivered prioritized recommendations that aligned competing interests and enabled evidence-based investment decisions.

Business Challenge

Indeed's sales leadership needed to understand how 2,000+ reps were selling Premium products before investing in new tools or processes. Without visibility into the actual end-to-end journey, they risked building solutions that didn't address real needs—wasting resources and missing revenue opportunities.

Impact At-A-Glance

✓ Built stakeholder alignment across GTM Strategy, Sales Operations, Revenue Transformation, and Product

✓ Translated fragmented feedback from 80+ participants into unified strategic framework

✓ Delivered tiered recommendations enabling immediate action while defining long-term vision

✓ Positioned UX as strategic partner in sales enablement, not just feature designers

✓ Established reusable methodology adopted for future product research initiatives

Artifact from a workshop where our audience described their process and tools within each step of their journey

Strategic Challenge

Stakeholders request: "Help us understand the sales journey for Premium so we know where to invest”

The Real Challenge: Competing Priorities Without Shared Understanding

Different stakeholders had conflicting views on what needed fixing:

Sales Operations wanted better lead identification

GTM Strategy wanted streamlined processes

Product Teams wanted to know which tools to improve

Sales Reps wanted less manual work

Without understanding the complete journey, each team would optimize their piece independently—potentially making the overall system worse.

Process

I followed a 4-phase research strategy balancing breadth and depth:

Phase 1: Inventory Mapping - Cast wide net documenting all touchpoints

Phase 2: Premium-Specific Deep Dive - Focus on product-specific nuances

Phase 3: Sales Focus Groups - Validate patterns through collaborative sessions

Phase 4: Cross-Functional Synthesis - Build alignment across competing perspectives

Example of impact/effort matrix to help clarify recommendations

Key Decisions

-

The Tension: Stakeholders wanted surveys to "move fast"

My Choice: Invested in contextual interviews and workshop observations

Why: Reps often can't articulate their workarounds—I needed to see what they actually did, not what they thought they did

Impact: Uncovered that reps created custom decks instead of using Seismic—a critical insight surveys would have missed

-

The Tension: Product teams wanted tool-specific feedback

My Choice: Mapped end-to-end journey showing how tools connect (or don't)

Why: Optimizing individual tools wouldn't solve the fragmentation problem—I needed to show the gaps between systems

Impact: Revealed that tool fragmentation, not tool quality, was the real issue—shifting investment strategy

-

The Tension: Leadership wanted "the answer"

My Choice: Delivered 6 recommendations prioritized by timeframe and impact

Why: Different teams needed to act at different speeds—quick wins build momentum while long-term bets drive transformation

Impact: Enabled immediate action while securing buy-in for long-term vision

-

The Tension: There is no unified vision of what our teams should be working towards, so each team works in silos to create short-term results but long-term headaches.

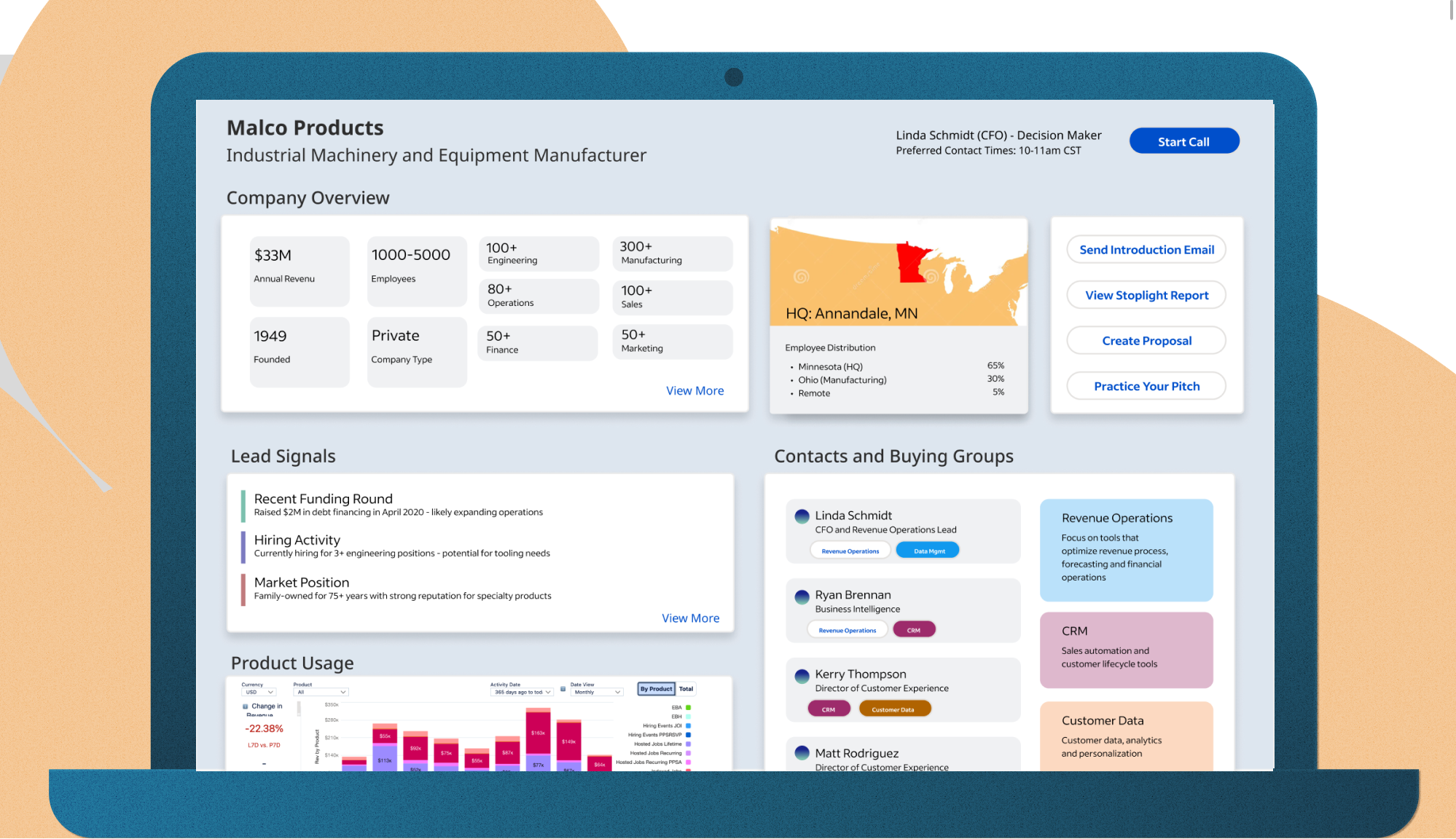

My Choice: Created a visual interpretation of what the future could look like in 5 years

Why: Offers a starting point to think towards long-term bets and unify teams behind a common goal

Impact: Teams can react to and align on common goals and coordinate to reach it as opposed to working in haphazard silos

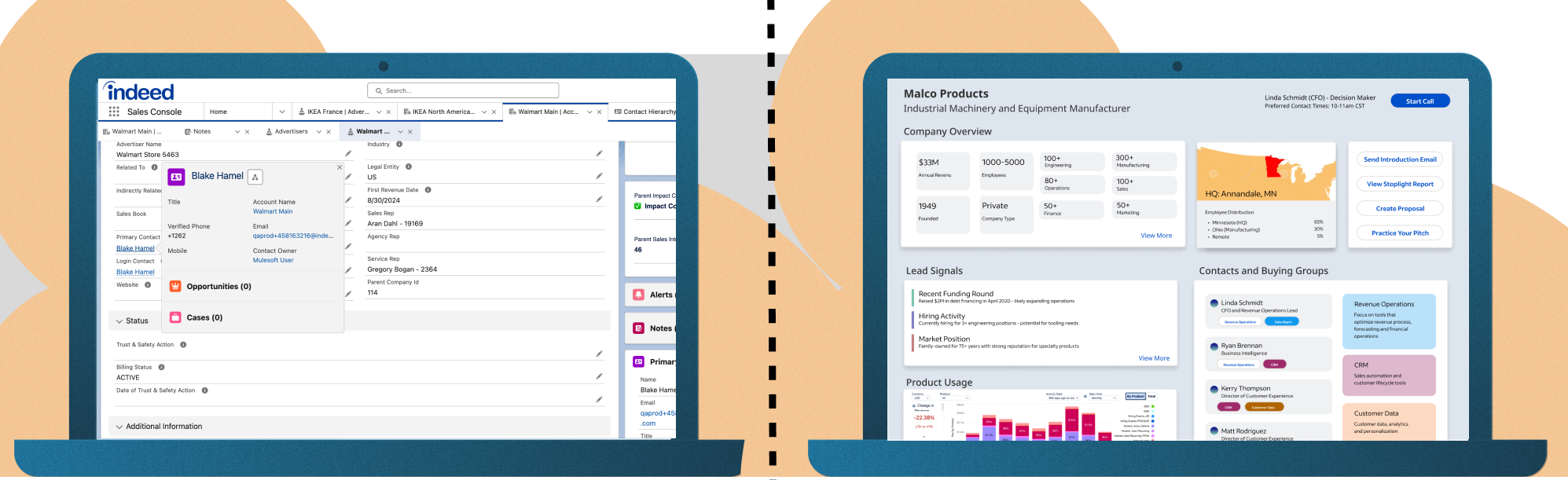

Showing the current experience vs. what the future could look like if our teams choose to work towards a common goal

Results

What This Research Enabled

✓ Aligned competing stakeholders around shared understanding of current state

✓ Shifted investment strategy from tool improvements to system integration

✓ Enabled evidence-based decisions replacing assumptions with user data

✓ Created reusable framework adopted for Enterprise segment research (Phase 2)

✓ Positioned UX strategically as research partner, not just feature designers